Overview

Innovation in technology has been rising at an unprecedented pace in today’s day and age. There is no doubt that technological advancements with artificial intelligence will play a key role in all sectors, which includes financial services. This session features a keynote describing the roles that technology plays in an individual’s life, a panel on consumer-centric technologies and governance, and a panel discussing how AI is transforming the financial services sector.

Keynote: AI Implementation in China: A Day in the Life in Shanghai (info | video)

In this session, Rich Turrin walks us through a day in his life in Shanghai and the role that technology plays. One notable role is with payment. Rich says that people in Shanghai has pretty much gone cash-free and most use either WeChat Pay or AliPay, which functions by scanning a QR code and utilizing the built-in facial recognition system. Additionally, Rich uses technology for speech to text translation, which helps in rideshare apps like Didi which has a built-in messaging and translation system to aid communication. Technology is also utilized in the creation of a COVID-19 monitor, which uses AI to track and trace COVID-19 and predict who might have the virus. Rich wants to emphasize that one should not see artificial intelligence as a cold war and ask, “Who is winning the AI race?” but rather embrace that innovation in AI is ultimately a good thing that brings a lot more benefits.

“This is not a cold war” – Rich Turrin, on the AI arms race

Panel: Consumer-centric AI Technologies, Governance and Experiences (info | video)

In this panel, the speakers discuss the impact of innovation within AI and technology and the importance of consumer-centric governance. With large data available created by users, machine learning can be used to extract a lot of significant insights. Unfortunately, it is mostly big companies who have access to majority of the data, which is a problem because smaller companies don’t have this access to utilize. The panelists believe that in order for AI to be implemented on a large scale in financial services, their trust must be won by the consumers. An important aspect is that consumers should be able to reap the benefits of using the technology without having to give away data. In essence, one’s digital “self” is not controlled by the individual but rather controlled by big companies, which can be problematic. The panelists believe strongly in the future of blockchain and cryptocurrency, which promises sovereignty over digital interactions.

“One’s digital self is not actually controlled by the individual” – Alex Tapscott

Panel: How AI is Transforming How We Interact with Financial Institutions (info | video)

This session featured panelists who discussed the different ways in which AI has transformed how we interact with financial institutions. From the consumer perspective, RoboAdvisors has helped with the financial service experience and AI has increased efficiency done on background checks. Additionally, banks have their own apps, with automated bots used both for security measures as well as answering customers’ questions, all done with machine learning. The panelists believe a key challenge that AI/Fintech need to address before mass adoption is to promote open banking, creating policy where consumers own their data instead of third-party institutions. Essentially, a landscape has to be created which puts the customer at the forefront.

Conclusion

Artificial intelligence is a field that will certainly play a key role in our lives going forward. Instead of focusing on potential threats of AI as it relates to an arms race between countries, it is important to embrace the innovation and see all the benefits that AI has brought to our lives. The developments in AI has led to a lot of consumer-generated data, and it is important to put the consumer at the front and in control of the data. This helps bridge the gap between the user and the financial institution to positively usher in the new wave that is artificial intelligence.

Missed FFCON20 RISE? Checkout the Session Recordings

Co-hosted by NCFA Canada and TFI, below is a collection FFCON20 DIGITAL: RISE keynote talks, fireside interviews, and panels taking place every Thursday at 1:45PM EDT from July 9 - August 27, 2020 at the 6th Fintech & Financing Conference. View the full program

Attendees experience a curated 8 week online event series covering the latest topics in fintech and funding in 2020, and get access to virtual networking with participants, the opportunity to interact and ask questions with speakers and special workshops, virtual socials and surprise content and experiences that are not recorded. FFCON Experience

We encourage you to attend FFCON20 to experience the full show. Having said that, the value and need for education has never been higher and FFCON20 organizers are happy to share this incredible content to advance dialogues and promote the development of the Canadian fintech industry. Checkout what's on this week, or register now

WEEK 1 - July 9, 2020: Scaling Fintech Funding, Innovation and Competition

WEEK 2 - July 16, 2020: Digital Banking (Open Finance) and The Future of Paytech

WEEK 3 - July 23, 2020: Sustainable Finance

WEEK 4 - July 30, 2020: Leadership, Adaptability and Culture

WEEK 5 - Aug 6, 2020: Digital Identity and Convergence Marketplaces (wrap-up)

WEEK 6 - Aug 13, 2020: Currency Wars, Digital Assets and Trading (wrap-up)

WEEK 7 - Aug 20, 2020: Artificial Intelligence in Fintech (wrap-up)

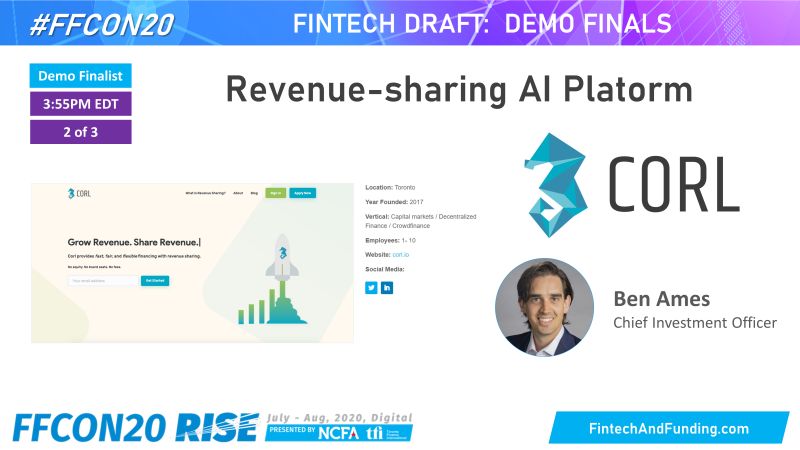

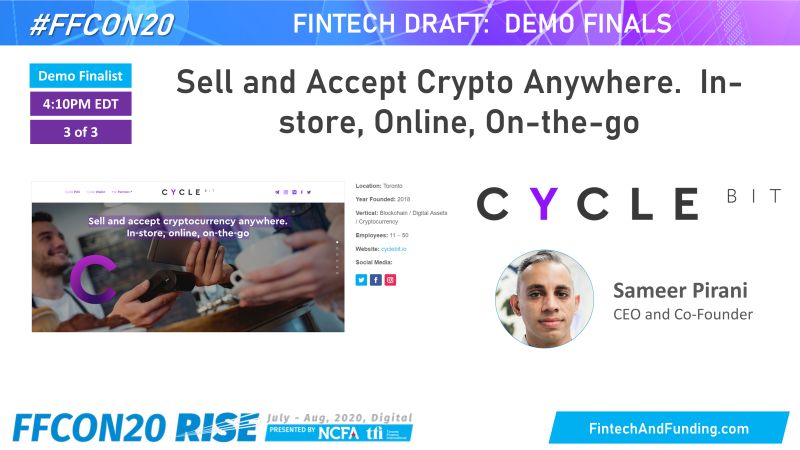

WEEK 8 - Aug 27, 2020: Fintech Draft Pitching & Demo Competition Finals